Algeria: The Trans-Saharan pipeline, a Nigerian alternative to Russian gas?

On 28 July in Algiers, following months of negotiations, Algeria, Niger and Nigeria signed a memorandum of understanding formalising the 4,000km Trans-Saharan Gas Pipeline (TSGP) project, which will enable Nigerian gas to be piped into Europe.

"This agreement marks the commitment of the three parties to revive a project of regional and international scope, which will boost the social and economic development of our country," Algeria's energy minister, Mohamed Arkab, said shortly after putting his signature to the agreement alongside his counterparts from Niger and Nigeria.

At the moment, this is just an agreement underpinned by "strong political will", Abdelmadjid Attar, a former Algerian energy minister and ex-CEO of the Algerian oil and gas giant Sonatrach, told Middle East Eye.

Meanwhile, an Algerian energy ministry official told MEE on condition of anonymity that "discussions will carry on between experts from the three countries".

In theory, the project involves building a pipeline designed to pipe gas from the Niger Delta towards In Salah, in the south of Algeria, passing through Niger.

Stay informed with MEE's newsletters

Sign up to get the latest alerts, insights and analysis, starting with Turkey Unpacked

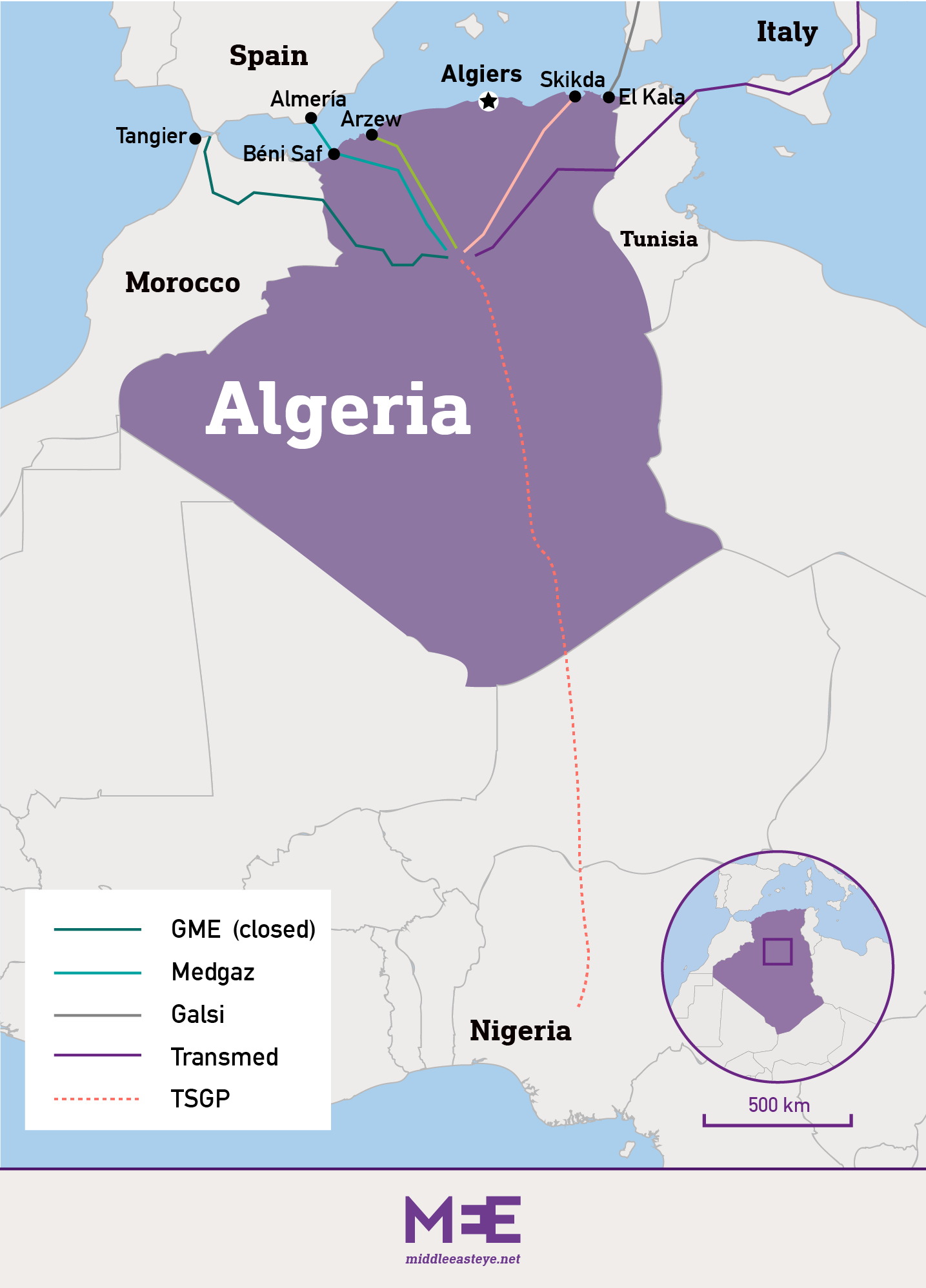

From a base at Hassi R'mel, in the north of the Sahara, nearly 30bn cubic metres of gas could be piped towards Europe via three existing gas pipelines: Transmed, which links Algeria to Italy via Tunisia; Medgaz, supplying Spain from the west of Algeria; and the Maghreb-Europe Gas Pipeline, linking Algeria and Spain passing through Morocco.

The Maghreb-Europe Gas Pipeline has been on hold since October 2021 when, after a breakdown in diplomatic relations between the neighbouring Maghrebi nations, Algeria decided not to renew the contract it had entered into with Morocco.

Financing problem

Without fixing a date, the three ministers spoke of the completion of an ambitious project "within the shortest possible timescale". According to experts, the pipeline could be completed in three years "if we push forwards", said Attar. If greater urgency is required, the former minister said, the timescale can be shortened.

'European countries want to see the project up and running within a maximum of two years'

- Former Sonatrach executive

"In the 90s we built the gas pipeline that links Algeria and Morocco in less than two years," said the former head of the Algerian oil and gas giant, indicating that the construction of the Trans-Saharan project could be similarly "swift".

For that to happen, headway must be made in resolving financing issues. Although Algeria and Nigeria, which together hold 90 percent of the shares in the company charged with constructing the pipeline, may have enough money to complete their respective parts of the project, Niger is too poor to participate in a programme with costs estimated in 2009 to exceed $10bn.

This amount is doubtless now even higher, driving countries such as Algeria to seek out external funding, specifically from China.

Sources within the Algerian ministry cite the "potential" for European financing as these countries actively seek alternatives to Russian gas. "European countries would like to see the project up and running within a maximum of two years," according to a former executive at Sonatrach, the national state-owned oil company of Algeria who spoke with MEE on condition of anonymity.

The Trans-Saharan Gas Pipeline project is not a new idea. Algeria first raised the subject with Nigeria in 2002, then with Niger. Subsequently, on several occasions, Nigeria reiterated its desire to pipe gas via trans-African pipelines to supply the European markets, currently supplied by more-costly gas tankers.

Consultations took place without tangible results. Then, in 2016, King Mohammed VI suggested routing a pipeline through Morocco.

On a visit to Abuja, the king expressed his hope that all countries of West Africa would benefit from the project. But such a project would require no less than $30bn and take some 10 years to complete. The project never got off the ground.

'New deal'

For the experts, the procrastination that has characterised the Trans-Saharan project is inextricably linked to the price of gas.

Until 2019, the price of a cubic metre of gas was "barely $4" on the spot markets, which made it an "uninteresting" and "unprofitable" business, Attar told MEE.

The war in Ukraine has changed all that. With the countries of Europe looking for gas suppliers outside of Russia, the TSGP has started to look attractive and "profitable".

"The project is highly profitable, not least because demand is high. Gas is tomorrow's energy, the energy of the transition, with a ready market driven by geopolitical change," said Attar, adding that the price of gas is nearing $30 per cubic metre and "won't go below the $20 mark, whatever happens".

The possible start of the TSGP "is coming at a unique time both in terms of the geopolitical panorama and the energy markets, characterised by a high demand for gas and petroleum and a stagnation in supply rooted in falling investment, particularly in the domain of oil and gas exploration, dating back to 2015," said Energy Minister Arkab.

Algeria, which currently exports nearly 56bn cubic metres of gas per year, would initially only be a transit country for the TSGP, but it will "benefit from the transit", Attar said.

The former executive of Sonatrach told MEE that Algeria "could increase its production capacity to export more energy". That can't be done right now "because Algeria's production is currently at maximum capacity".

On top of these benefits, if the project is completed, Algeria would reap political dividends, boosting its strategic position on the African continent. "Algeria needs to carve out a good place for itself within Africa and not remain on the side-lines," President Abdelmadjid Tebboune said in a televised interview broadcast on 1 August.

He described the proposed pipeline as a "major African project".

For Attar, the project is also "extremely important at the trans-African level", since it would bring African countries closer together and build ties with Niger, Nigeria and Burkina Faso, "a country with scant resources that will benefit from this project".

Nigeria has the biggest gas reserves in Africa, holding some 5.5 trillion cubic metres (30 percent of the continent as a whole), followed by Algeria with 4.5 trillion (25 percent of production).

In 2020, the two countries accounted for 86 percent of exports of African gas, 58 percent corresponding to Algeria, which has the continent's biggest gas pipeline network, and 28 percent to Nigeria. More than 62 percent of these exports are destined for Europe, according to data supplied by the Policy Center for the New South.

*This article was originally published in French.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.